vkyryl/iStock via Getty Images

While shipping and airline stocks made the majority of the top five gainers for the week ending April 14, energy/power-related stocks dominated the decliners’ list.

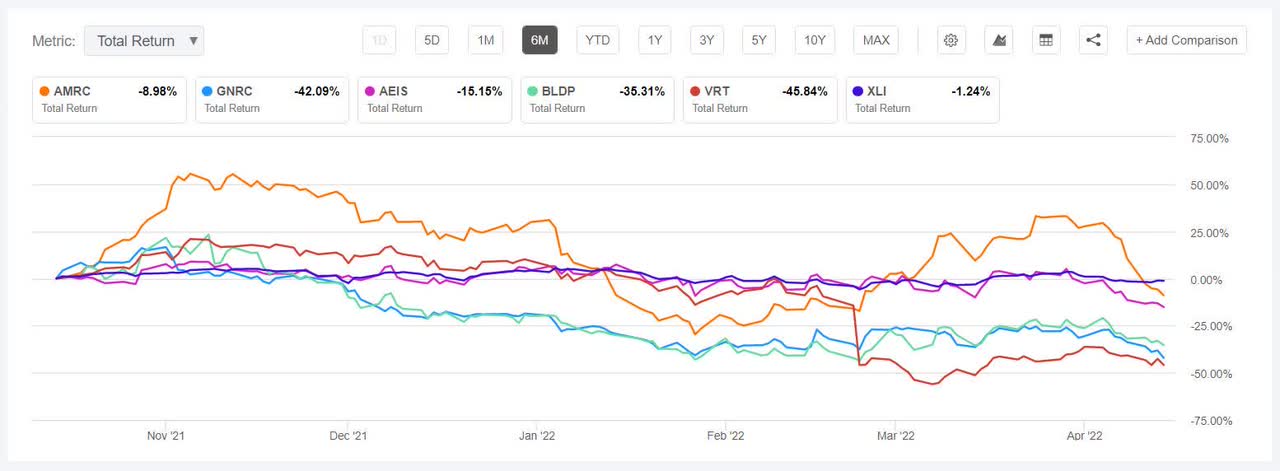

The SPDR S&P 500 Trust ETF (SPY) -2.45% was in the red for the second week straight. YTD, the ETF is -7.83%. The Industrial Select Sector SPDR (XLI) -0.22% was in the red three weeks in a row. YTD, XLI is -5.55%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +12% each.

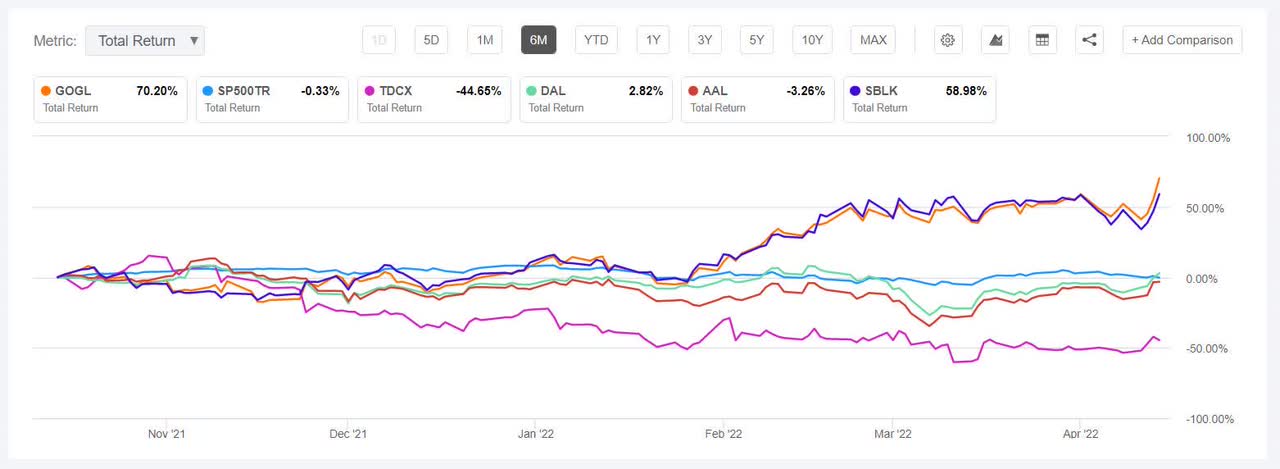

Golden Ocean Group (NASDAQ:GOGL) +15.59%. The Bermuda-based shipping company led the to five list, while another shipping peer Star Bulk Carriers (SBLK) was not far behind in gains. Golden Ocean gained the most on April 14 (+9.65%). The Wall Street Analysts’ Rating is Buy with an Average Price Target is $12.25. YTD, the stock has risen +46.67%.

TDCX (TDCX) +14.94%. The company, which provides outsource contact center services, rose the most on April 12 (+10.06%). The Singapore-based vendor for Facebook and Airbnb, listed on the NYSE in October 2021. However, YTD the stock is down -28.09%.

The chart below shows 6-month total return of the top five gainers and SP500TR:

Delta Air Lines (DAL) +14.09% and American Airlines (AAL) +12.09%, came in third and fourth, respectively.

Delta’s Q1 results, which beat analysts’ estimates, showed that pandemic recovery has continued. Total passenger revenue was 75% recovered from the level in Q1 of 2019 on system capacity that was 83% restored.

Meanwhile, Barclays upgraded Delta to Overweight from Equal Weight, while JPMorgan raised its price target on Delta to $69 from $57, following the company’s earnings result.

The travel and leisure sector as a whole also got a boost on April 13 when Delta disclosed that it had the highest bookings ever over a five-week period. Airline ETF JETS rose +5.3%, while airline stocks that broke higher included American Airlines (AAL). Fort Worth, Texas-based American Airlines rose throughout the week, the most on April 13 (+10.62%).

Star Bulk Carriers (SBLK) +12.03%. The Greece-based shipping company was back in the top five after two months. The company has been a star performer for the investors as it was among the top 5 industrial stocks of 2021 (+156.74%).

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -8% each. YTD, all the stock are in the red.

Ameresco (NYSE:AMRC) -24.54%. The company fell the most on April 11 (-12.10%) after it said on April 10 that COVID-19 lockdowns in China may delay battery deliveries. The energy solutions provider, YTD has lost -29.91%.

Generac (GNRC) -15.41%. YTD, the stock of the Waukesha, Wis.-based power generation equipment maker has fallen -28.62%. However, the Wall Street Analysts’ Rating is Strong Buy, with an Average Price Target of $444.67.

The chart below shows 6-month total return performance of the worst five decliners and XLI:

Advanced Energy Industries (AEIS) -8.77% and Ballard Power Systems (BLDP) -8.56%, came in close third and fourth, respectively. YTD, AEIS is down -18.76%, however the Wall Street Analysts’ Rating is Buy with and Average Price Target of $106.45. SA contributor The Value Investor has written, Advanced Energy Industries: Hiccups In The Advancement.

Canada-based Ballard was among the worst five performing industrial stocks of 2021 (-46.32%) and it has continued this trend in 2022, with YTD being down -19.19%. SA contributor Henrik Alex wrote in March, Ballard Power – FY2022 Likely To Be Even Worse – Sell.

Vertiv (VRT) -8.09%. The Ohio-based company, which provides equipment and services to data centers, leapfrogged from the gainers’ list it found itself in two weeks ago to land among the losers this week. YTD, the stock has lost more than half its value (-50.42%).